How To Set Up Mile Iq

If you lot're a rideshare or delivery driver, then you lot're responsible for roofing a lot of your own expenses.

You lot have to pay for gas, vehicle maintenance, and likely a car payment as well.

All of these expenses can add together up quickly, seriously eating into your profits.

While it doesn't appear that rideshare and commitment companies volition beginning reimbursing drivers any time soon, there is another way that you can get at to the lowest degree a scrap of a break for all the expenses that you incur.

The IRS allows you to deduct your operating expenses when you file your taxes.

It won't cut downwards on your expenses direct, but it will help you pay less in taxes.

In order to take this taxation deduction, however, yous need to go on very conscientious records of how many miles you've driven.

Until recently, this would have been a catchy, frustrating process involving frequent consultation of your odometer.

These days, however, there are plenty of apps to aid you with tracking your mileage.

One of our favorite mileage tracking apps is called MileIQ.

In this post, nosotros'll pause down what the app is, how information technology works, and how you can start using information technology to track your mileage today.

Why You Should Track Your Mileage

Before we get into the details of MileIQ, we need to discuss why it's and so important to rails your mileage.

When yous're doing whatsoever kind of independent contractor driving job, y'all should be tracking your mileage (unless the person you work for reimburses your expenses).

The IRS wants you to have advantage of this tax deduction, so long as all the miles you track are "business miles."

For instance, all the driving y'all do while picking up or transporting passengers for Uber would count equally business miles.

The same goes for making deliveries with platforms like DoorDash, Postmates, and Uber Eats.

So how exactly does the mileage deduction work?

The IRS actually allows you to calculate it two different means.

The showtime method involves keeping a detailed record of all your business concern-related driving expenses.

While this tin work, it's time-consuming and prone to errors.

We don't recommend it.

Instead, we recommend that you use the 2nd method: tracking your miles driven.

For every mile y'all drive for business organisation purposes, the IRS allows you lot to deduct $0.58 (this is known as the business mileage rate).

This may not sound like a lot, just when you're driving dozens of miles per twenty-four hours, it can easily add up to savings of hundreds or fifty-fifty thousands of dollars off your taxation pecker.

Nosotros hope that you're convinced of the importance of tracking your miles.

But how do you actually do it without frustration and wasted time?

Enter MileIQ.

What Is MileIQ?

MileIQ is an automatic mileage logging app for mobile and desktop.

It uses the GPS technology in your telephone to log the number of miles you've driven on a specific trip.

The app works in the background, then you can just set it and forget it.

Afterwards each drive ends, MileIQ will then prompt yous to categorize the drive every bit either business or personal.

Over time, this data will add upwardly to an accurate mileage log that y'all can consult when information technology comes time to practice your taxes.

Y'all can so write off the business miles, leaving at least one part of your taxes that you don't take to worry nearly.

How to Use MileIQ

So how can you get started using MileIQ for your own business organisation?

To start, you'll need to sign up for a subscription.

MileIQ offers 2 different subscription plans:

Basic:

This plan is gratis, merely it limits you to tracking 40 drives per month.

If you only practice a fleck of rideshare or commitment driving, this might be enough.

Most drivers, however, will want to look into the Unlimited plan.

Unlimited:

This is the MileIQ premium subscription.

For $five.99 per calendar month, you lot go unlimited tracking and reports.

If you want to save a bit of money, y'all can also pay for the Unlimited plan on an annual basis.

This brings the effective monthly toll down to $4.99 (ane annual payment of $59.99).

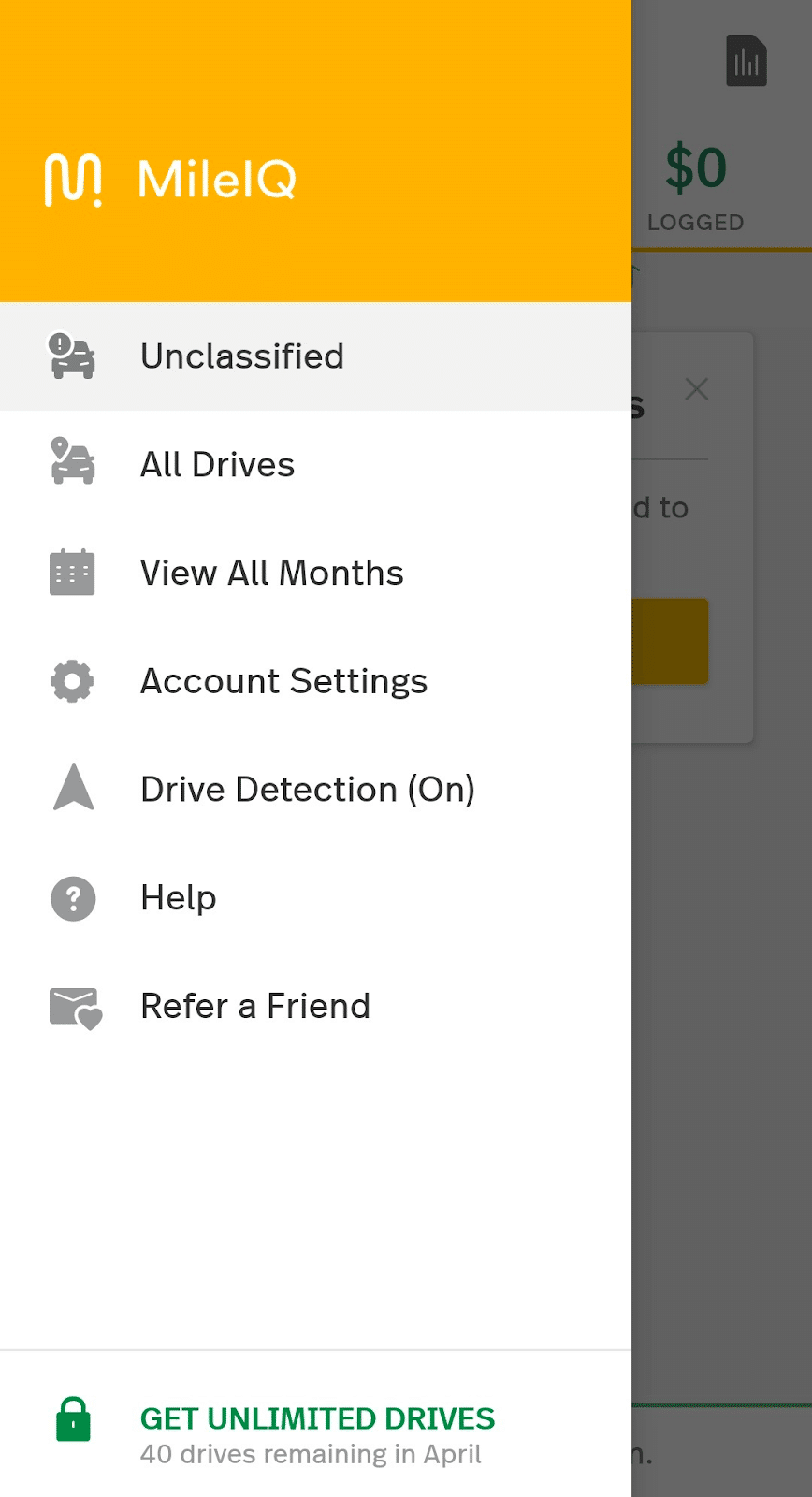

After you've chosen your subscription, you'll desire to download the MileIQ app.

Information technology's available on the App Store (iOS devices) and Google Play Store (Android devices).

The MileIQ website talks a lot about their web dashboard, but the mobile app is what'due south actual useful for tracking and reviewing your mileage on a daily basis.

In one case you've installed the MileIQ app, you'll need to create an account with an e-mail address and password of your choice.

From there, using the app is quite easy.

Yous may have to adjust your phone's bombardment saving settings and then that MileIQ can run in the background, but across that, y'all can basically only set the app and forget it.

Afterward each drive, MileIQ will just ask you to swipe right or left to classify your drive as either business or personal.

You can then view detailed mileage reports any time you want, either within the app or online at www.mileiq.com.

The app volition fifty-fifty automatically calculate your potential deduction for each business drive you lot take.

That's really all in that location is to it, and this simplicity is what makes MileIQ one of our favorite mileage tracking apps.

MileIQ FAQ

To conclude this guide, here are answers to some mutual questions about MileIQ

i. Can I deduct the cost of MileIQ?

It's pretty meta, but yes, yous can.

Since MileIQ is a software for concern purposes, it'due south totally tax-deductible.

2. Is MileIQ office of Microsoft?

Aye, information technology is. Microsoft acquired Mobile Information Labs (the company behind MileIQ) in 2022.

Due to this, MileIQ is now works with Office 365.

You don't accept to have Function 365 in order to use MileIQ, however — the integration of the two products is mostly aimed at larger organizations who need a mileage tracking solution for their employees.

3. Does MileIQ piece of work outside the United states of america?

To a limited degree, yes.

MileIQ is currently bachelor to download in the The states, Canada, and U.k..

However, the MileIQ team states on their website that they "are working hard to release versions of MileIQ to other countries soon."

Hopefully, they'll observe a style to make the app bachelor in other countries ASAP, equally information technology could be a bully benefit to all the rideshare and delivery drivers beyond the earth.

4. How tin can I get assist with my gig piece of work taxes?

When you're self-employed, taxes can feel overwhelming.

This is especially true if you lot've never had to file self-employment taxes before.

Luckily, nosotros have a guide that can help you articulate upwardly a lot of the confusion and put you in control of your taxation situation.

Get Started Tracking Your Mileage Today

Nosotros hope this guide has shown you how powerful MileIQ can be for tracking your business miles and deducting as much as yous can off your taxes.

To learn more virtually MileIQ, visit the app's official website.

Happy mileage tracking!

[gw_subscribe style="circles"]

Source: https://gigworker.com/mileiq/

0 Response to "How To Set Up Mile Iq"

Post a Comment